For many younger individuals, especially those in Gen Z, the dream of owning a home can feel distant amid rising home prices, mortgage rates, and inflation. With these challenges, it’s easy to wonder if homeownership is truly within reach. While the current housing market may seem daunting, it’s important to know that it’s still possible to become a homeowner with the right strategies and support. With professional guidance, you can navigate the obstacles and achieve your goal of owning a home.

For many younger individuals, especially those in Gen Z, the dream of owning a home can feel distant amid rising home prices, mortgage rates, and inflation. With these challenges, it’s easy to wonder if homeownership is truly within reach. While the current housing market may seem daunting, it’s important to know that it’s still possible to become a homeowner with the right strategies and support. With professional guidance, you can navigate the obstacles and achieve your goal of owning a home.

Here are some helpful tips for younger homebuyers to make their dream a reality.

1. Explore Your Options for a Down Payment

For many first-time buyers, the down payment is often the biggest hurdle. The good news is, there are several options available to help with this critical step. In fact, over 2,000 down payment assistance programs exist to make homeownership more achievable. Many younger buyers may not realize that putting 20% down isn’t always necessary. Depending on the type of loan and lender, a lower down payment could be sufficient. Additionally, a significant number of Gen Z homebuyers have received financial support from family members to help with their down payment. Working with a trusted mortgage professional can help you understand how much you’ll really need for a down payment and how you can take advantage of any available assistance programs or gifts.

2. Live with Loved Ones to Boost Your Savings

An increasing number of younger buyers are choosing to move back in with family or friends to boost their savings. By cutting down on housing costs, you can save a larger portion of your income toward your future home. According to Bankrate, 30% of Gen Z homebuyers move directly from living with family to purchasing a home of their own. This strategy helps increase your financial security, allowing you to reach your savings goal faster while benefiting from lower living expenses.

3. Cast a Broad Net for Your Search

Once you’ve saved enough for a down payment, it’s time to start your home search. Given the current challenges in the market, it’s important to broaden your search and remain flexible. Working with a professional real estate agent can help you explore neighborhoods and home types that you might not have initially considered.

4. Take a Close Look at Your Wants and Needs

When it comes to finding your first home, it’s essential to distinguish between what you truly need and what would be nice to have. Your first home doesn’t have to be your forever home. It’s more important to focus on securing a property that allows you to start building equity. Being open-minded and willing to make some compromises on your wish list can make a big difference. Working with a real estate agent will help you prioritize your must-haves and focus on homes that align with your budget and long-term goals. They’ll also explain how buying a home now can eventually lead to moving into your dream home as your equity grows.

While the path to homeownership may not be simple, it is achievable, especially with the right strategies and expert advice. By exploring down payment assistance options, living with loved ones to save more, and being flexible in your home search, you can bring your dream of homeownership closer to reality. Working with experienced professionals will guide you through the process and ensure that your first step into the housing market is a successful one.

Owning a home is an important goal for many people, and as a single mom, it can sometimes feel like a distant dream. But the reality is that homeownership is more achievable than you might think, especially when you know about the financial resources and programs available to you. First-time homebuyer grants, special loan programs, and down payment assistance can help you overcome the financial barriers that might otherwise stand in your way. Here’s what single moms should know about these opportunities.

Owning a home is an important goal for many people, and as a single mom, it can sometimes feel like a distant dream. But the reality is that homeownership is more achievable than you might think, especially when you know about the financial resources and programs available to you. First-time homebuyer grants, special loan programs, and down payment assistance can help you overcome the financial barriers that might otherwise stand in your way. Here’s what single moms should know about these opportunities. Embarking on the journey to homeownership is an exciting milestone, but it also requires careful financial planning. One crucial aspect is managing your debt effectively. I want to ensure you have the tools and knowledge to navigate this process smoothly. Let’s discuss some essential strategies for managing your debt while purchasing a home.

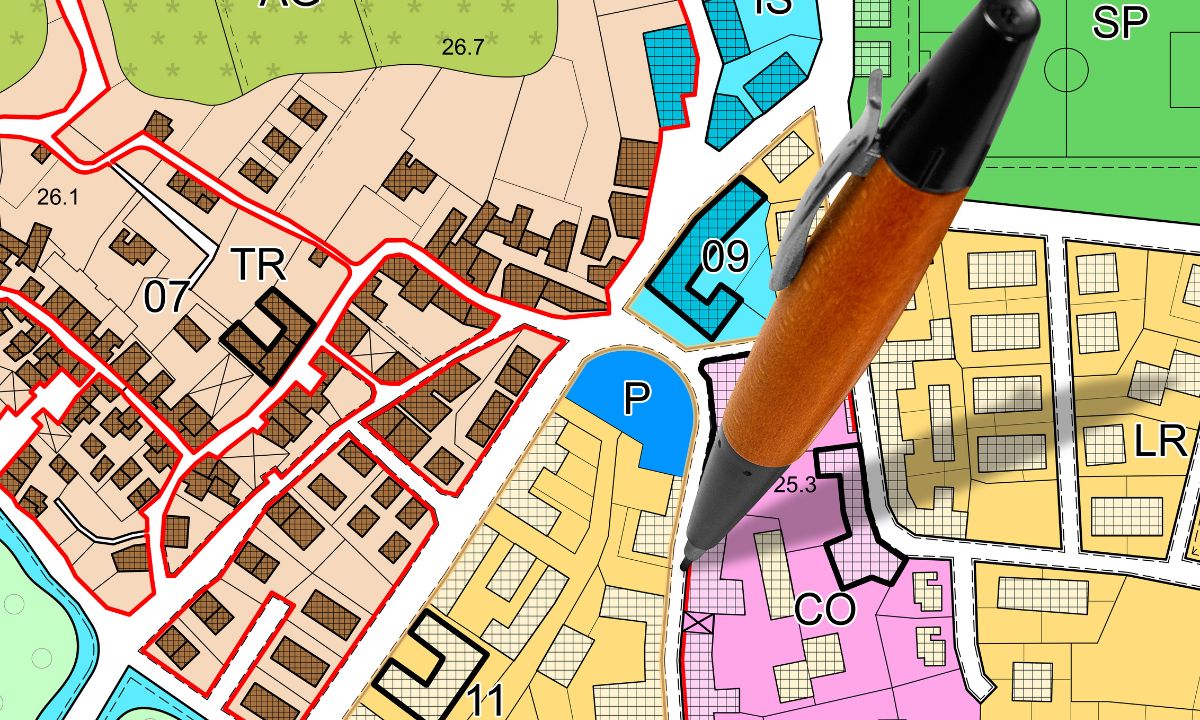

Embarking on the journey to homeownership is an exciting milestone, but it also requires careful financial planning. One crucial aspect is managing your debt effectively. I want to ensure you have the tools and knowledge to navigate this process smoothly. Let’s discuss some essential strategies for managing your debt while purchasing a home. Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience.

Purchasing a home is an exciting milestone, but it’s important to be aware of the various factors that can influence your decision. One often overlooked yet crucial aspect is understanding zoning laws and regulations. These rules can significantly impact your property rights and the future use of your home. We will discuss what zoning laws are, why they matter, and how they can affect your homebuying experience.