Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss.

Federal housing agencies and government-sponsored enterprises Fannie Mae and Freddie Mac are responding to the COVID-19 outbreak with multiple relief programs for homeowners experiencing hardship due to illness and job loss.

60-Days Forbearance on Home Mortgages Owned or Backed by Fannie Mae or Freddie Mac

Many U.S. home loans are owned or guaranteed by Fannie Mae or Freddie Mac. Homeowners can determine if your loan is connected with Fannie Mae here.here. Please check here to check if your mortgage is affiliated with Freddie Mac.

CARES Act Provide Relief for Eligible Homeowners

The federal Coronavirus Aid, Relief and Economic Security Act provides two protections for homeowners:

- Payment forbearance for homeowners impacted by the COVID-19 emergency. Forbearance periods up to 12 months may be approved based on individual hardship.

- Foreclosure and other legal actions are stopped for 60-days.

Forbearance may require a lump sum payment of deferred payments after the forbearance period or deferred payments may be added to the back of a mortgage, but fees may not be added to the loan balance.

Loan Modifications

Mortgage servicers may provide modification of loan terms to assist homeowners impacted by COVID-19. Modification terms can include:

- Reduction of mortgage interest rate

- Extension of the loan repayment term.

- Capitalization of unpaid principal and/ or interest to principal balance; this means adding unpaid amounts to the mortgage balance.

Contact your mortgage servicing company as soon as you know you will miss a mortgage payment or payments Relief programs usually require documentation verifying financial hardship. Mortgage servicers are experiencing high volumes of calls; you may need to call multiple times for assistance.

Mortgage Assistance for Non-Government Owned Loans

If you have a conventional mortgage that is not owned or backed by a government agency, please call your loan servicing company and ask about mortgage relief provisions. If your loan is covered by private mortgage insurance (PMI), ask your loan servicer if that company can help with relief options.

State and local agencies may offer housing relief options to homeowners and renters. Certified credit counseling agencies can also help with determining budgeting needs and local resources in addition to working with unsecured creditors toward reducing payments on credit card debt and personal loans.

Last week’s economic reporting included readings on pending home sales, Case-Shiller Home Price Indices, and Bureau of Labor Statistics reports on national unemployment. Weekly readings on mortgage rates and first-time jobless claims were also released.

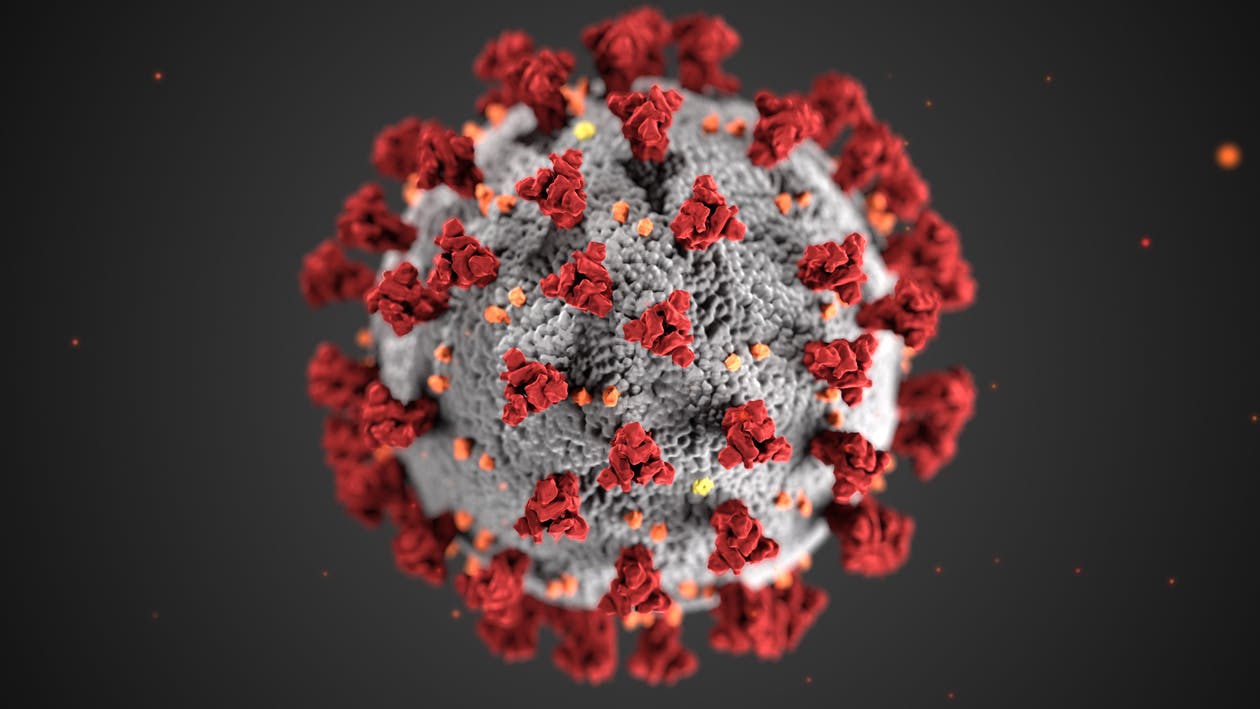

Last week’s economic reporting included readings on pending home sales, Case-Shiller Home Price Indices, and Bureau of Labor Statistics reports on national unemployment. Weekly readings on mortgage rates and first-time jobless claims were also released. The COVID-19 (Coronavirus) pandemic has impacted every industry across the country. Many people are being asked to shelter in place and everyone has been asked to practice social distancing to try to curtail the spread of this deadly virus.

The COVID-19 (Coronavirus) pandemic has impacted every industry across the country. Many people are being asked to shelter in place and everyone has been asked to practice social distancing to try to curtail the spread of this deadly virus. United States home prices increased by 3.90 percent year-over-year in January as compared to December’s growth rate of 3.70 percent according to Case-Shiller’s National Home Price Index. Home prices also rose in Case-Shiller’s 20-City Home Price Index.

United States home prices increased by 3.90 percent year-over-year in January as compared to December’s growth rate of 3.70 percent according to Case-Shiller’s National Home Price Index. Home prices also rose in Case-Shiller’s 20-City Home Price Index. During the COVID-19 pandemic, it is more important than ever for everyone to make sure they act in the best interests of their local communities and the world as a whole. This means that everyone should follow the advice of the Centers for Disease Control and Prevention (CDC), practice social distancing measures, and obey all orders to shelter in place. When families are stuck at home, it is important to ensure the house is sanitized. This will prevent the spread of this dangerous virus. There are a few measures that everyone should take to make sure their home is as clean as possible.

During the COVID-19 pandemic, it is more important than ever for everyone to make sure they act in the best interests of their local communities and the world as a whole. This means that everyone should follow the advice of the Centers for Disease Control and Prevention (CDC), practice social distancing measures, and obey all orders to shelter in place. When families are stuck at home, it is important to ensure the house is sanitized. This will prevent the spread of this dangerous virus. There are a few measures that everyone should take to make sure their home is as clean as possible. For many months, the COVID-19 (Corona-virus) pandemic appeared to be a problem that only existed in foreign lands. Now, this virus has arrived on the shores of the United States and has disrupted jobs, hospitals, and lives. People are being asked to practice social distancing measures to curtail the spread of the virus while some parts of the country are being asked to stay home entirely. The good news is that there are still ways for people to remain social while being safe.

For many months, the COVID-19 (Corona-virus) pandemic appeared to be a problem that only existed in foreign lands. Now, this virus has arrived on the shores of the United States and has disrupted jobs, hospitals, and lives. People are being asked to practice social distancing measures to curtail the spread of the virus while some parts of the country are being asked to stay home entirely. The good news is that there are still ways for people to remain social while being safe.